Maximizing Margins with DFM

Design for manufacturing speeds development, compliance, and approval while trimming away costs. Orthopedic Design & Technology expands on this principle in the following article, quoting our very own Steve Dieter.

There is nothing medical device manufacturing (MDM) engineers or designers like better than to be unleashed through design for manufacturing (DFM). This freedom allows them to use their creative and technical skills, and depth of knowledge to produce the best possible product in the most efficient and cost-effective manner.

A resurgence of DFM in the orthopedic and spine industries has occurred over the last several years. In the past, product development (PD) teams focused on product features, quality, and speed to market—all very important factors—without thinking too much about DFM because their margins were high. Manufacturing was generally addressed at the end of the product development timeline; cost savings were reviewed only after the product was launched and started generating revenue.

This is starting to change. MDMs are still focused on features, quality, and speed to market; however, these are harder to achieve with more complex technologies, miniaturization, advanced materials, and more stringent regulations—all of which increase costs and slow down speed to market. MDMs are now reaching the point where they are taking a harder look at DFM. Although it takes more time and money, DFM is the best way to manufacture the highest-quality product with the most cost-effective process—and still get to market quickly, with a smoother approval process. And, over the product lifecycle, DFM reduces total costs.

“DFM means continuously considering manufacturability throughout the entire development process,”

said Steve Dieter, director of mechanical engineering for bb7, a Madison, Wis.-based product development firm that works closely with the medical device industry.

“Designers consider the manufacturing process from the beginning of conceptualization—sometimes even letting the manufacturing process inspire the design. Accomplished engineers draw on their own experience with manufacturing processes and additionally seek the input of manufacturing partners in order to develop robust, efficient designs.”

The other big driver behind the increased push for DFM is to improve profit margins by reducing both manufacturing and lifecycle costs. This increases competitiveness, market share, customer satisfaction, and brand reputation. In the past, design engineers in the orthopedic and spine industries enjoyed such strong margins that they would just design products and make up for costs in the marketplace. Over the last five years, however—especially in the trauma, extremities, and total joint segments—increasing pricing pressures have MDMs looking for cost relief through manufacturing processes.

“Approximately 75 percent of the cost of a product is in the actual design and 25 percent of the cost is in the process,” said Steve Maguire, general manager for Orchid Design, a Shelton, Conn.-based subsidiary of Orchid Orthopedic Solutions, a Lansing, Mich.-based provider of design and development services to the medical device industry. “Therefore, companies are leveraging design to reduce manufacturing costs. DFM is becoming increasingly important as the pricing pressures intensify across most segments of the industry.” Removing costs from existing products must especially focus on optimizing the manufacturing process.

“Today we’re redesigning products with DFM being the main focus,” said Victoria Trafka, president and lead engineer for Engineering & Quality Solutions, a Colorado Springs, Colo.-based contract engineering and development company specializing in orthopedic trauma and spine implants and surgical instruments. “It is possible—and sometimes challenging—to redesign and maintain all of the product features and quality, while reducing cost. The key is to involve manufacturers and truly understand these processes throughout the course of design.”

How DFM Works

Much of DFM consists of computer-based studies, modeling, and simulations. Addressing manufacturability in the concept stage encourages selection of the design with the best prospect of success—in fact, it is often the best strategy to delay final concept selection until a manufacturability analysis has been completed on all candidate concepts. Software tools such as finite element analysis (FEA) are important for testing the limits of a design to identify potential failure points, and the conditions under which they occur. Depending on the type of material selected, flow simulation studies for melted resins can provide vital information on how the injection-molding cavity fills, and where product weaknesses or flaws might form. Simulations are also rapidly becoming more sophisticated—in the past, simulations could take a week to complete; now decisions can be made in a matter of days, with better data.

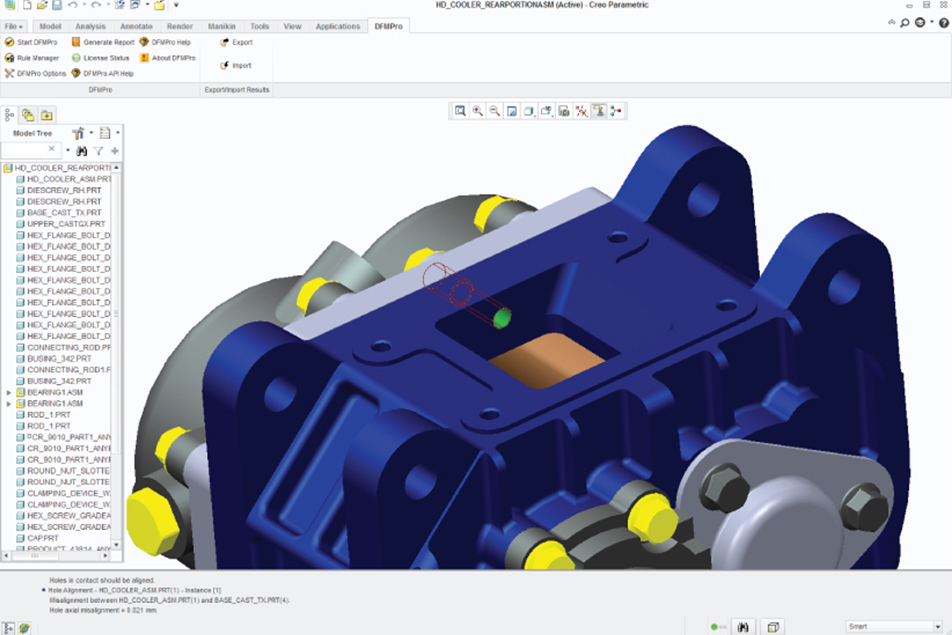

Computer-aided design (CAD) companies are reacting to the increasing popularity of DFM by rolling out improvements or additions to their software packages to include modules for manufacturing (for example, DFM-Pro). “Engineers can design something, push a button, and the software will tell them if there are any hotspots causing problems,” said Maguire. “For example, it will show you if a pocket is too deep for an end mill diameter, or if it turns it into a 5-axis project instead of a 3-axis.”

Addressing manufacturability in the concept stage encourages selection of the design with the best prospect of success—in fact, it is often the best strategy to delay final concept selection until a manufacturability analysis has been completed on all candidate concepts.

This enhanced CAD DFM capability allows the cost of manufacturing to be included as a design parameter early in the product development cycle, which helps bridge the gap between designers and producers and improves DFM efforts. “They are also linking directly with 3D printing software so that product printability can be considered concurrently with the design,” said Trafka. “This also improves manufacturing cost value by enabling quick prototyping of parts to be reviewed.”

Additive manufacturing (AM) and 3D printing are becoming key considerations in DFM—not just as potential manufacturing processes for the product, but also as a way to quickly make prototypes and test molds as the DFM process is being carried out. This delivers a part or product model into the hands of a manufacturing team quickly, which helps the team identify and correct any manufacturing problems. In this regard, AM is especially worthwhile because it adds value as timeline reductions and cost pressures across healthcare systems continue to increase.

“The ability to test multiple iterations of a design in a short time span condenses the product development timeline,” said Dieter.

3D printing also enables part reduction, because it allows for the combination of parts—a very key consideration in design. 3D printing can be used to build models for tooling and gaging, or even the parts that hold the product for laser marking and testing. New material alloys, formulas, and structures are also being developed very rapidly for AM. As a result, devices are being designed specifically for these materials and processes—a perfect example of DFM in action. Also, as 3D-printing technologies progress, they will be used more in the production environment, especially for complex part designs that can’t be made with traditional manufacturing processes.

“The limiting factor for 3D printing in manufacturing is throughput,” said Dieter. “But at the right volumes and as production speeds improve, 3D printing can be the right choice.”

What OEMs Want

More MDMs are trying to establish manufacturing cost goals up front, before product development and manufacturing start. They are highly focused on reducing costs, without giving up quality. “A design input should be more than just what you need the product to do, but also include what it needs to cost to manufacture,” said Maguire. “Five years ago, this was not a common practice. We are working with our customers now to help them target how much the products need to cost in order for them to be successful as a business.”

“Smaller, resource-constrained OEMs will often rely more heavily on manufacturing partners to provide suggestions for improved design, from a manufacturing perspective,” said Chad Ryshkus, director of marketing and product development for MedTorque Inc., a Kenosha, Wis.-based Tier 1 supplier of close tolerance machining, DFM, and complex instrument assembly for the medical device industry. “Larger OEMs, although also resource-constrained, often have a manufacturing lead on their project teams who interact with suppliers on DFM activities.”

Trafka indicated a growing number of her medical device clients are asking to have products designed with a particular manufacturing method, or supplier, in mind. These mandates are specified as a project requirement, along with other project development requirements such as product features or function.

“They’re doing this in an effort to control costs, leverage existing relationships or investments, reduce project timelines, and optimize designs,” she said. “But at the same time, they’re asking for innovative DFM solutions, like combining a couple of tried-and-true technologies to produce an optimized product in terms of design and manufacturing approach.”

When you have the opportunity to design for higher volumes, you can manufacture with plastics, metal injection molding, and stampings. These all require a different kind of DFM than we’ve had in the past on the instrument side.

In the instrument business, instruments have typically been re-useable. Because MDMs often don’t get reimbursed, many are trying to get up to half of the cost out of the instrument sets through redesign, before they are replaced. “This cost stress has also resulted in an increased demand in single-use procedure kits, which can involve a completely different set of processes in manufacturing,” said Maguire. “When you have the opportunity to design for higher volumes, you can manufacture with plastics, metal injection molding, and stampings. These all require a different kind of DFM than we’ve had in the past on the instrument side.”

Design for inspection or design for quality also needs to be considered with DFM. Many MDMs often do not understand that metrology plays a key part in the development of the manufacturing process. How will the part be measured? How can the drawings and CAD models explain how to measure it? “The cost of manufacturing always includes some cost of inspection,” continued Maguire. “The traditional approach has been just to inspect more, so the manufacturers are doing things that provide a lot more inspection data. With the compliance becoming a larger factor in our industry, design for inspection is just as important as design for manufacturing.”

Why Not Always Do DFM?

The most misunderstood aspect of DFM is how it reduces costs—many companies still see DFM as an expense rather than an investment in product improvement. For example, making and studying prototypes as a step in DFM is rarely used, yet it is critical for streamlining the manufacturing process and improving throughput at less overall cost. As margins get slimmer, DFM is starting to get more attention within the medical device industry. By comparison, in the automotive industry, DFM is absolutely at the forefront of design because margins are so small that automakers can’t afford not to do everything within their power to eliminate cost. This is starting to happen with MDMs. Part of the reluctance to embrace DFM is also due to a lack of education and experience—many product development engineers simply have not been exposed to manufacturing processes and their impacts on profitability.

Another significant pressure for not investing in DFM is aggressive project-development timelines. “Companies are shrinking their timelines,” said Trafka. “It takes time to involve manufacturing, listen to their feedback, and make changes. Everyone is working to meet their own goals and timelines and then ‘throwing the project over the wall’ to the next group. But the payback for applying DFM is huge—imagine adding an extra month to the PD timeline for DFM, but saving 20-50 percent on production cost over thousands of products a year.”

The benefits of DFM aren’t always obvious to clients, who are eager to save money and tend to dismiss the value of DFM because they haven’t seen or experienced it. Also, many designers work on their own projects in a bubble, without understanding the “big picture” of how DFM improves production and reduces risk. Trafka estimated the added cost for performing a DFM study within the product development cycle is roughly less than 10 percent of the total cost. However, in contrast, without DFM, there is a greater probability of problems arising after production starts or after the product launches—which would likely be far more expensive to correct.

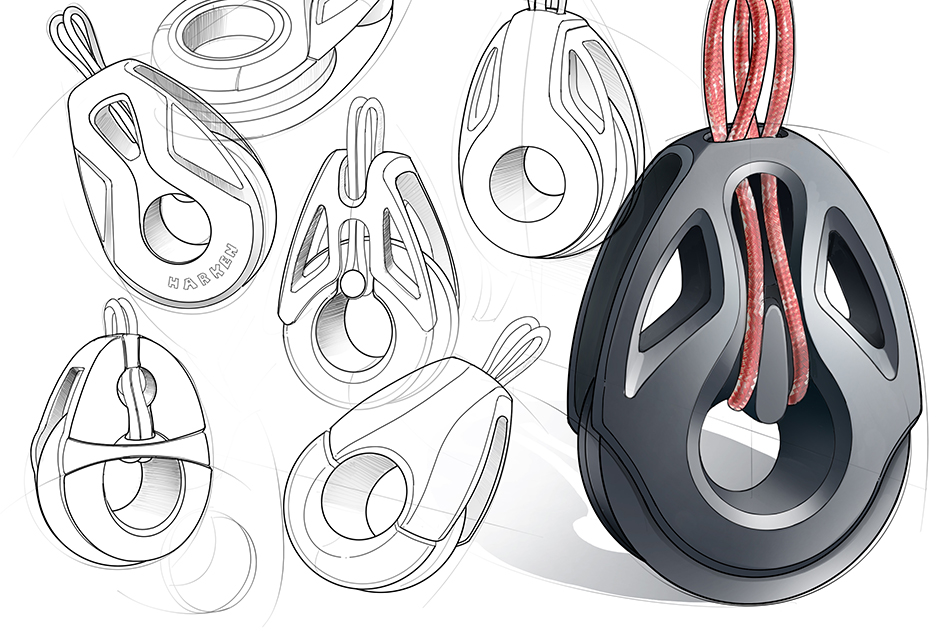

“It’s much more economical to make changes in the concept phase than in detailed design or later,” said Dieter. “To emphasize this, we often include a DFM workshop earlier in the industrial design effort than is standard in the industry. This can be a bridge between the concept phase and the detail design phase, or a way to help down-select concepts that are otherwise close or on par with one another. DFM workshops allow the client to review the concepts alongside industrial design, engineering, and manufacturing representatives. We talk through the processes required and the challenges presented by each of the concepts to help the client make an informed decision.”

Overall, once a company tries DFM, it sees the benefits of the process and starts using it more. DFM should be a net positive when it comes to overall costs, pointed out Ryshkus. “There will be some investment in time and resources early on, as design iterations balance out the design outputs to match inputs,” he said. “However, the overall savings gained from manufacturing efficiencies and scrap reduction greatly outweigh those costs.”

For example, MedTorque helped a customer create a modular design that reduced the total number of parts and standardized key features. The reduced part count allowed the design team to utilize common components across the family for improved costs and lead times. “We were successful in achieving about a 25 percent cost reduction from the original design,” said Ryshkus. “The fact that we needed to manufacture fewer components, which reduced the need for custom tooling, allowed us to deliver product a few weeks sooner than would have been possible with the original design.”

In another example, EQS designed three different variations of a product for a client, each variation meant for a different manufacturing approach. The client then took those designs and investigated the product costs, product features, and overall pros and cons—ultimately selecting the design variation that best suited their needs. “Our extensive DFM experience with medical devices, and our close relationships with suppliers and manufacturers, enabled us to do this very efficiently, and with minimal added development time,” said Trafka. After the initial design was completed, designing and prototyping for the two additional designs took about a month and only added about $5,000 to the budget.

Up Front with DFM

Pricing is currently one of the biggest pressures in the orthopedic device market. More companies are involving their contract manufacturers up front in the design process to maximize production efficiency and reduce overall costs. “More of our customers are starting to contact us early with new projects and asking to learn about DFM,” said Nick Belloli, business development manager for Orchid Orthopedic Solutions. “They are intent on developing manufacturing variables into the design phase, so we don’t have to fix any issues later.”

DFM workshops allow the client to review the concepts alongside industrial design, engineering, and manufacturing representatives. We talk through the processes required and the challenges presented by each of the concepts to help the client make an informed decision.

Some companies—especially startups—are resource- or time-constrained when it comes to their product launches. As a result, they especially count on their manufacturing partners for wisdom and guidance. “When we are able to assist them with any aspect of their manufacturing process, it is like extending the capabilities of their team,” said Ryshkus. “DFM allows our customers to leverage our technical expertise to create a more efficient design—both from a cost and lead time perspective.”

Brad Garner, director of engineering for Turner Medical, an Athens, Ala.-based subsidiary of In’Tech Medical, a global orthopedic contract manufacturer, agreed. “DFM is something we provide to all our customers from the initial quote,” he added. “We see our role as much as consultants as manufacturers. If we run into technical challenges, catch mistakes, or identify opportunities to save cost and cycle time, we point them out and make proposals. That is where the real value is for the customer: our savoir-faire and machining expertise.”

However, despite all the advantages that DFM can offer, sometimes customers have no flexibility, or have stringent engineering change order processes that steer them away from utilizing the DFM process.

Moving Forward

DFM can be a critical asset in streamlining U.S. Food and Drug Administration (FDA) approval. A product launch can take years (especially for new technologies). Doing DFM up front is a great way to have ready answers for FDA questions, speed validation, and create the most stable process possible. FDA reviewers are more educated than they used to be about the potential effects of manufacturing processes and variations, and are using that knowledge to ensure safer products for the end user. In some situations, such as additive manufacturing and specialty coatings, product clearance is specific to the validated and controlled manufacturing process and any potential change must be considered for re-submittal to the FDA. “This is where DFM becomes a requirement because the manufacturing process is locked in and is therefore an integral part of the product design, function, and regulatory clearance,” said Trafka.

For new process technologies, such as additive manufacturing or metal injection molding, the FDA is issuing more guidelines. “The lesson many of us have learned over the last few years is that, with increasingly stringent regulations, it is better to use DFM to design a product in the best appropriate way, with cost targets built in up front,” said Belloli.

A problem for many organizations, however, is that they don’t have a culture that promotes and supports the interdisciplinary cooperation needed for DFM to succeed. For example, “some MDMs still think the supplier should be selected after the design is frozen, which may not be the most progressive thinking,” said Maguire. “There are some companies with purchasing departments that do not encourage engineers to talk to suppliers during development. Some strategies rely on getting the cost out with competitive quoting, rather than utilizing engineering to build cost out of the design and process and by partnering with a supplier early so DFM can be utilized.”

For long-term success, noted Trafka, it is imperative that the workplace culture of manufacturing and product development groups work toward the common goal of overall success of the project—that the product developers create great designs and the manufacturers have robust and cost-effective processes so the end users get devices that perform as intended/needed at the best possible cost. “Everyone could be more successful if the groups would take just a little time with DFM to understand the challenges with both design and manufacturing of a certain product,” she concluded.

Originally published by Orthopedic Design & Technology on November 22, 2016. Written by Mark Crawford (Madison, WI).